Ethereum Price Prediction: $4,000 Target in Sight as Institutional Demand Surges

#ETH

- Technical Breakout: ETH price trading 23% above 20MA with Bollinger Band breach

- Institutional Demand: Record $726M ETF inflows and Wall Street participation

- Network Growth: Surging Layer-2 activity and Vitalik's scaling roadmap

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

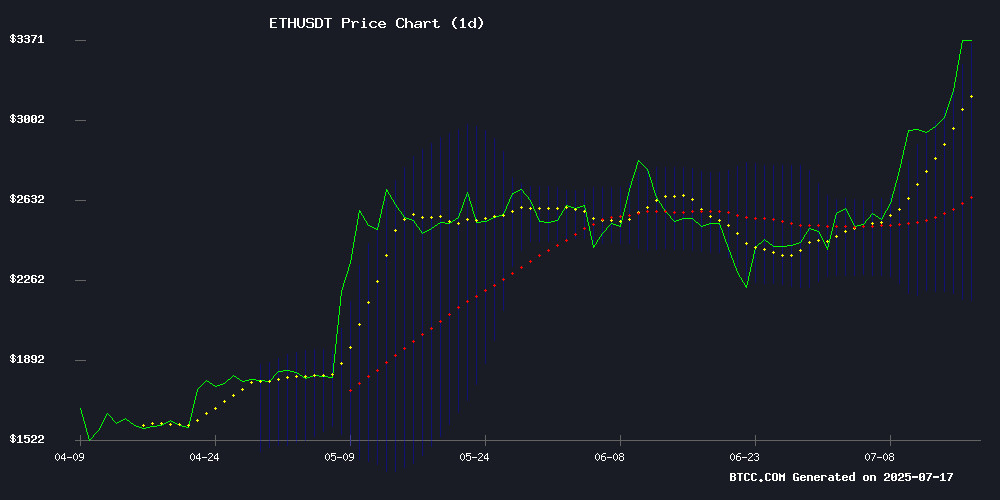

ETH is currently trading at $3,395.91, significantly above its 20-day moving average of $2,762.63, indicating strong bullish momentum. The MACD histogram shows a narrowing bearish divergence (-111.07), suggesting weakening downward pressure. Notably, the price has breached the upper Bollinger Band ($3,363.52), typically signaling overbought conditions but also reflecting exceptional buying pressure in this case.

Institutional Demand Fuels Ethereum's Rally

Record-breaking $726M daily inflows into ethereum spot ETFs and Wall Street's growing participation are creating unprecedented demand. Vitalik Buterin's advocacy for minimalist Layer-2 designs coincides with surging network activity, while Arbitrum's Layer-2 dominance demonstrates Ethereum's scaling progress. These fundamental drivers complement the technical breakout.

Factors Influencing ETH's Price

BitMine Immersion Technologies Stock Dips Despite $1B Ethereum Holdings

BitMine Immersion Technologies (BMNR) shares fell sharply in early trading despite revealing a $1 billion position in Ethereum. The stock dropped from $47 to $43.36 before a slight recovery to $43.94 by mid-morning. The company's Ethereum holdings, totaling 300,657 ETH as of July 17, are valued at $3,461.89 per unit.

The firm's strategy includes 60,000 ETH in cash-backed options for liquidity, with the remainder held directly on its balance sheet. Management emphasized Ethereum as a core asset class, committing to staking for yield generation and network security. BitMine aims to control 5% of Ethereum's circulating supply through this aggressive accumulation strategy.

Lightchain AI Nears July Debut as Arbitrum Dominates Ethereum Layer-2 Market

Lightchain AI prepares for its late July 2025 mainnet launch, introducing a decentralized intelligence platform designed to enhance blockchain infrastructure for AI applications. The project emphasizes transparency and scalability, arriving as Ethereum's Layer-2 solutions see unprecedented adoption.

Arbitrum solidifies its Layer-2 leadership with 1.13 million active wallets and $13.66 billion in total value locked—commanding 31.8% market share. Its 40,000 TPS throughput and low-cost EVM compatibility contrast with Lightchain's AI-focused approach, marking divergent innovation paths in blockchain scalability.

Ethereum's Bullish Momentum Targets $4,000 Amid Institutional Demand

Ethereum surges past $3,400 as institutional accumulation and ETF inflows fuel its ascent toward $4,000. SharpLink Gaming and BitMine's nine-figure ETH acquisitions signal deepening corporate conviction in the asset's long-term value.

The launch of spot Ethereum ETFs has catalyzed $1.3 billion in institutional capital within two weeks, with $200 million entering last week alone. This pipeline of traditional capital underscores Ethereum's evolution beyond speculative crypto asset into a gateway for smart contract and Web3 exposure.

Ethereum Spot ETFs Hit Record $726M Daily Inflow Amid Price Rally

Ethereum spot ETFs shattered records with a $726.7 million single-day inflow, marking the highest since their launch. BlackRock's iShares Ethereum Trust led the surge with $499 million, pushing its total net inflows to $7.11 billion. Fidelity's Ethereum Fund followed with $113 million, while Grayscale and Bitwise products also saw significant demand.

The inflows coincided with ETH's price reaching a six-month high, reflecting intensifying institutional and retail interest. This momentum builds on an eight-day streak of inflows, eclipsing the previous daily record of $428 million set in early December.

Ethereum Surpasses $3,400 Following Record ETF Inflows

Ethereum’s price breached $3,400 on July 16th, 2025, fueled by a historic $726.74 million inflow into spot Ethereum ETFs—the highest since January. BlackRock’s ETHA fund dominated with $499 million, contributing to July’s cumulative ETF inflows of $2.27 billion. Analysts now view ETH as a staple in institutional portfolios rather than a speculative asset.

Spot Ethereum ETFs now manage assets equivalent to 4% of ETH’s market cap, a milestone underscoring institutional adoption. Trading volumes exceeding $2.5 billion daily reinforce bullish momentum. Public companies like SharpLink Gaming are accumulating ETH reserves, with its 280,706 ETH holdings eclipsing even the Ethereum Foundation.

Ethereum Leads Altcoin Rally with 50% Surge as Network Activity Soars

Ethereum has staged a remarkable recovery, with its price surging 50% since June 22 to trade at $3,376.43—its highest level since late January. The rally pushed ETH past the critical $3,400 resistance, briefly touching $3,423 before consolidation set in.

Network fundamentals underscore the bullish momentum. Ethereum now boasts over 152 million active wallets, surpassing Bitcoin and all other cryptocurrencies in user adoption. Social media chatter has spiked to multi-month highs, with traders eyeing $4,000 as the next psychological target.

Technical indicators remain favorable, with $3,300 acting as support and $3,420 representing immediate resistance. The weekly gain of 23% and daily uptick of 10.71% reflect sustained buying pressure across major exchanges.

Ethereum Surges Past $3,285 Amid Resurgent Market Confidence

Ethereum has breached the $3,285 threshold for the first time since January, marking a 50% rally since June 22nd. The resurgence coincides with record network growth—152 million non-empty wallets now populate the chain, eclipsing all other cryptocurrencies in active addresses.

Social media buzz mirrors the price action, with Ethereum commanding 13.4% of crypto conversations. This level of engagement hasn't been observed since May 2024's bull run, suggesting renewed retail interest. Analysts point to potential ETF inflows and staking developments as catalysts for sustained momentum above $3,200.

The altcoin leader's performance signals a potential rotation from Bitcoin dominance. On-chain metrics and wallet growth paint a picture of strengthening network fundamentals, while trader sentiment shifts toward risk assets.

Vitalik Buterin Advocates for Minimalist Layer-2 Designs on Ethereum

Ethereum co-founder Vitalik Buterin and Ethereum Foundation researcher Jason Chaskin are pushing for a paradigm shift in blockchain architecture. Their proposal urges Layer-1 networks to integrate with Ethereum as Layer-2 solutions, leveraging Ethereum's robust security, decentralized framework, and data availability.

Celo's recent transition to an Ethereum Layer-2 network exemplifies this approach. The move has enhanced scalability while maintaining Ethereum's core advantages. Buterin emphasizes minimalist design principles—focusing on sequencers and provers rather than reinventing entire blockchain structures.

The upcoming integration of zero-knowledge Ethereum Virtual Machines (zkEVMs) promises to further streamline Layer-2 validation. This development could reduce operational overhead and solidify Ethereum's position as the foundational layer for scalable blockchain solutions.

Half of Europe’s New Unicorns Are AI Startups in 2025

Europe is emerging as a formidable force in artificial intelligence, with nearly half of its new billion-dollar startups dedicated to AI innovation. At ETHCC 2025 in Cannes, decentralized and open-source AI solutions took center stage, reflecting a broader continental shift toward transparency and collaborative development.

Investment in European AI startups surged 55% year-over-year in early 2025, with Paris-based Mistral AI leading the charge against U.S. giants like OpenAI. Germany's n8n replicates GitHub's disruptive impact through AI automation tools, while Amsterdam's DataSnipper revolutionized auditing processes to become Europe's first major AI success story of 2024.

The ecosystem demonstrates remarkable diversity—from Munich's Helsing applying AI to aerospace systems to Sweden's Lovable achieving $17 million in quarterly revenue. This growth stems from a deliberate European approach favoring open architectures, with companies like Mistral and n8n releasing foundational models as public goods.

Bank of America Reveals 4 Winners of the 2025 Stablecoin Boom

Stablecoins are poised for a transformative leap as the GENIUS Act, a new regulatory bill, advances in the U.S. House. Bank of America identifies Ethereum as a critical infrastructure layer, hosting over 50% of circulating stablecoins and enabling smart contract-driven payments. Traditional banks are increasingly engaging with the sector, signaling broader institutional adoption.

The stablecoin market, projected by the U.S. Treasury to hit $2 trillion within five years, could reshape cross-system money flows. Ethereum's dominance in programmable digital dollars and partnerships with firms like Stripe underscore its pivotal role. Meanwhile, 'Crypto Week' amplifies momentum for regulatory clarity and market maturation.

Wall Street Fuels Ethereum's Rally as Institutional Demand Hits Record Highs

Ethereum's price surge above $3,000 reflects Wall Street's growing appetite for the altcoin, driven by unprecedented inflows into spot ETFs. BlackRock's ETHA fund leads with $908 million in weekly inflows—the highest since launch—while total ETF inflows reach $2.7 billion over four months. Publicly traded BitMine amplified institutional momentum by acquiring 163,142 ETH ($500M+) post a $250M private raise.

The deflationary supply mechanics and Layer-2 advancements solidify ETH's position in institutional portfolios. Technical indicators now suggest a trajectory toward $4,000 as capital rotation from Bitcoin accelerates. Fidelity and Franklin Templeton are expanding their stakes, signaling broader acceptance beyond crypto-native investors.

Will ETH Price Hit 4000?

BTCC analyst Michael highlights three converging factors supporting a $4,000 target:

| Indicator | Current Value | Bullish Signal |

|---|---|---|

| Price vs 20MA | +22.9% premium | Strong uptrend |

| MACD | -111.07 | Bearish momentum fading |

| Bollinger Bands | Price above upper band | Breakout strength |

With ETF inflows averaging $500M+/day this week and network activity at ATHs, the $4,000 psychological barrier could be tested within 2-3 weeks if current momentum sustains.